Scenario

For QNE Optimum software version 2019.0.1.2 and below, require to update tax code.

Solution

- Go to File > Modules

- Tick GST/VAT/SST. Save & Close

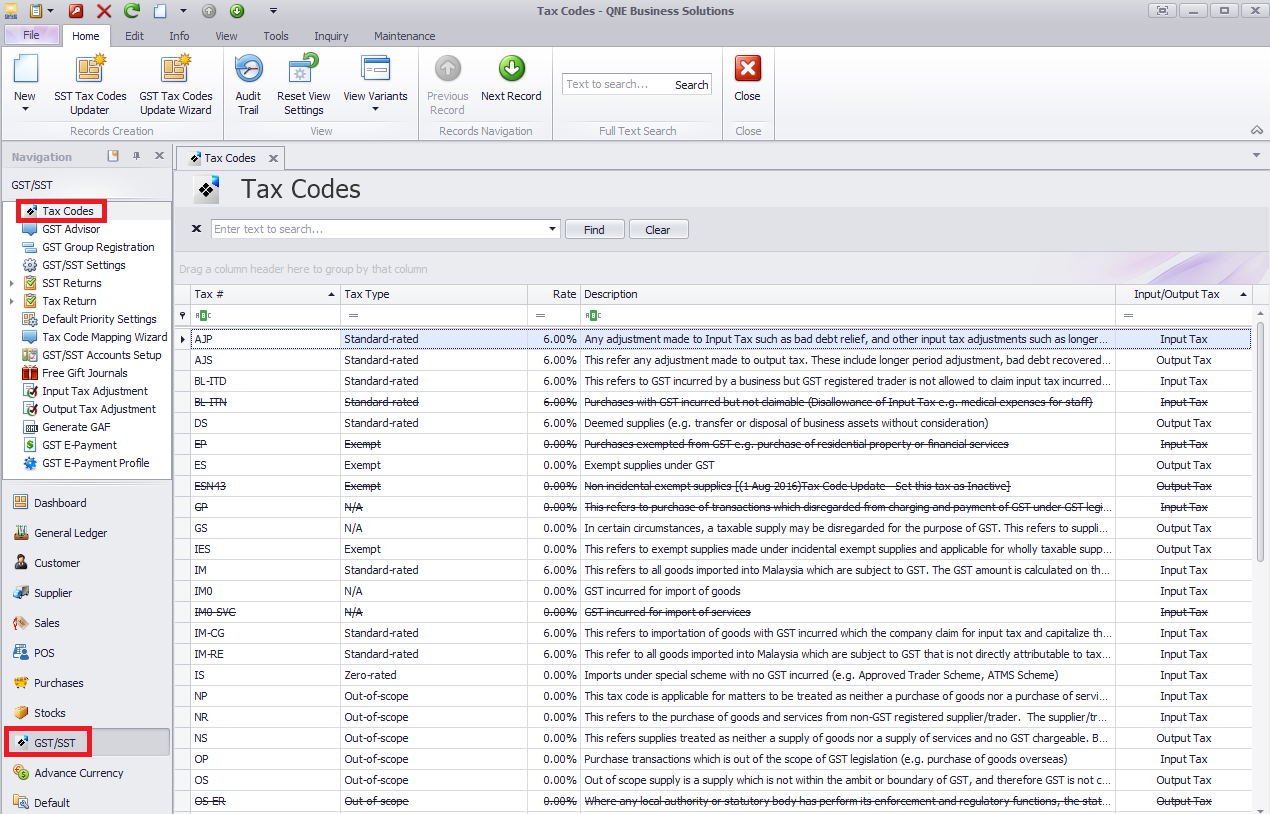

- Go to GST/SST > Tax Code. Notice that all tax codes haven’t been updated

- At Tax code > Home > Click SST Tax Codes Updater icon

- Click Submit. System will create SST tax codes as below

- Notice all tax codes are up to date upon submit. Click Close.

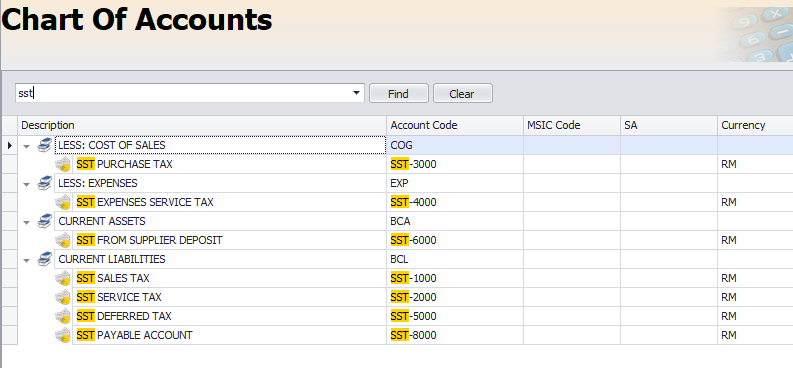

- Go to GST/SST Accounts Setup. Click Apply. In this step, system will define the GL account into the tax code we created just now at step 5

- Go to General Ledger > Chart of Accounts. Notice new GL Account codes have been created successfully.

- Go to GST/SST > Notice that system has created the new SST Tax Codes

- Click inside the tax codes, system has defined the GL Posting account in the tax code.

- Continue to define the taxable period category in GST/SST Settings. Set it as 2 months.

And set for the Effective Date

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article