Overview:

Setting up financial periods correctly is critical for accurate accounting, reporting, and compliance.

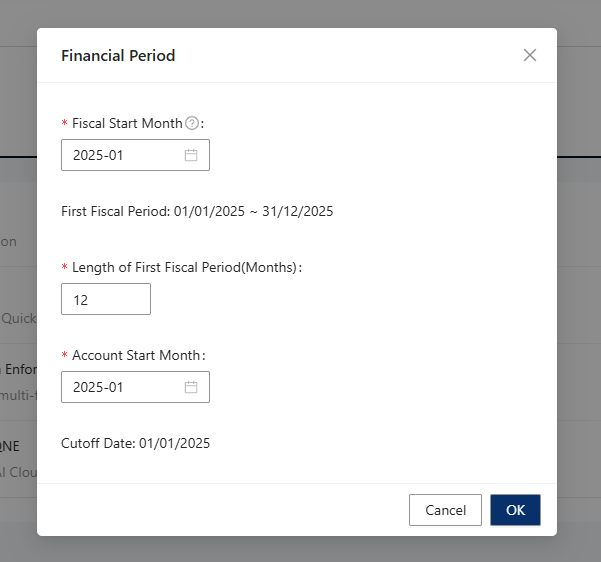

In most accounting systems, key financial period settings such as Fiscal Start Month, Length of First Fiscal Period, and Account Start Month (Cut-off Date) play an important role during initial setup or when migrating to new software.

This guide explains these terms to help you configure your system properly and understand their impact on financial records and reports.

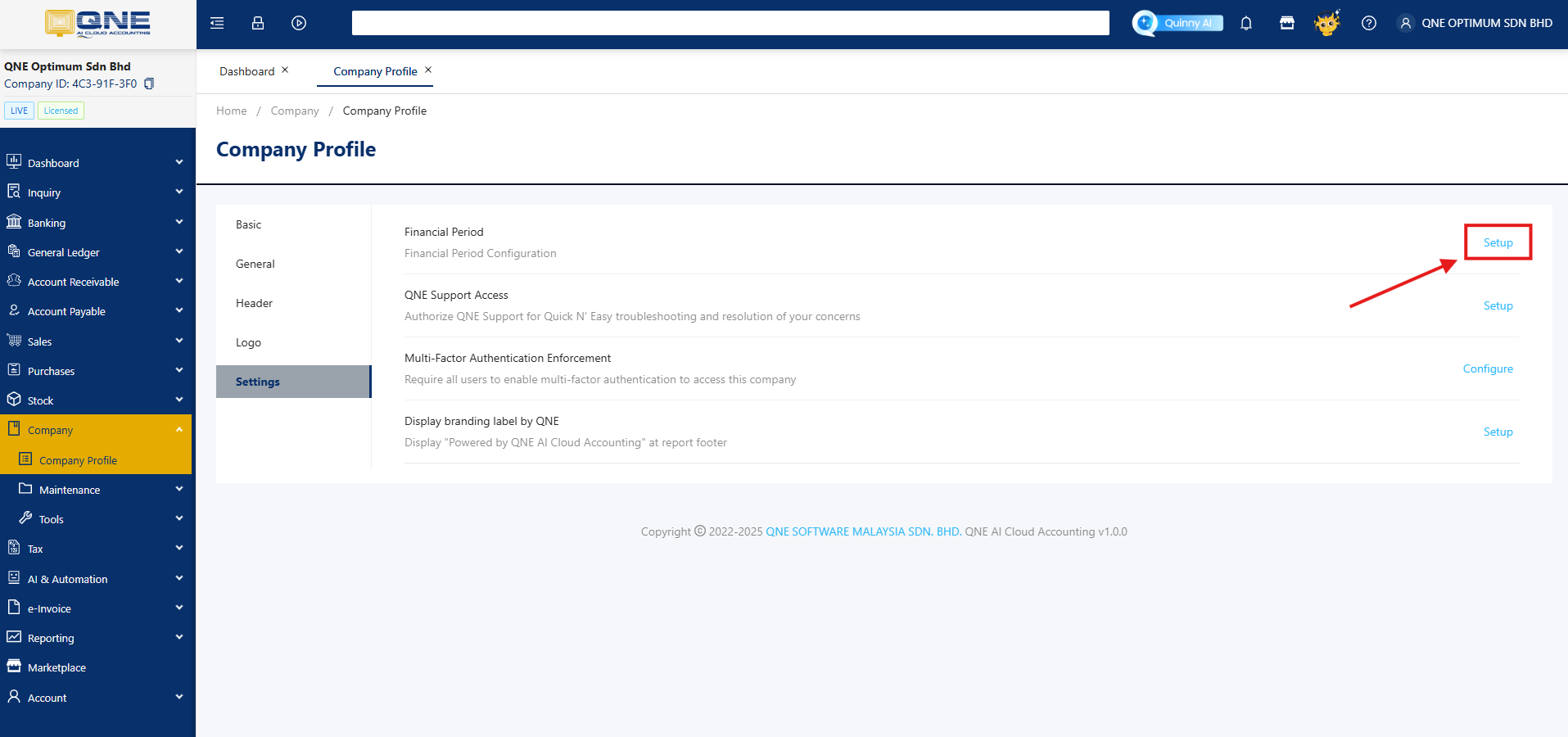

Note: User can expand Company> Company Profiles> Settings> Financial period

Solution:

1. Fiscal Start Month

The Fiscal Start Month is the month in which your company’s financial year begins. Unlike the calendar year (January to December), a fiscal year can start in any month depending on your business needs or local regulations.

Example:

If your fiscal year starts in April, your fiscal period runs from April 1, 2025 to March 31, 2026.

2. Length of First Fiscal Period

This setting defines the duration (in months) of your first fiscal year. It’s mainly relevant when:

- You’re setting up a company for the first time.

- You’re changing the fiscal year structure.

The first fiscal period can be shorter or longer than 12 months up to 18 months to align with your preferred fiscal start month.

3. Account Start Month (Cut-off Date)

The Account Start Month—also called the Cut-off Date—is the point at which you start recording live transactions in your accounting system. Anything before this date is typically entered as opening balances only.

Example:

If you start using a new accounting system in January 2025, then your Account Start Month is January 2025. You enter your trial balances as of December 31, 2024, and begin recording new invoices, payments, and transactions from January 1 onward.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article